Sales tax hike approved by St. Paul voters

St. Paul voters approved a 1% sales tax increase in the city on November 7 by a wide margin.

Elected officials put forth the ballot measure, which they say will raise nearly $1 billion over the next 20 years, to pay for street repair and parks improvement, with about 75% of the funding going to streets and the other 25% to parks.

City leaders claim the sales tax increase is a necessary step to pay for our infrastructure, pointing out that a sales tax increase will also allow visitors to the city to help bear the burden of the costs rather than increasing property taxes on St. Paul’s residents. Opponents largely point to the fact that St. Paul will now have one of the highest sales tax rates in the state.

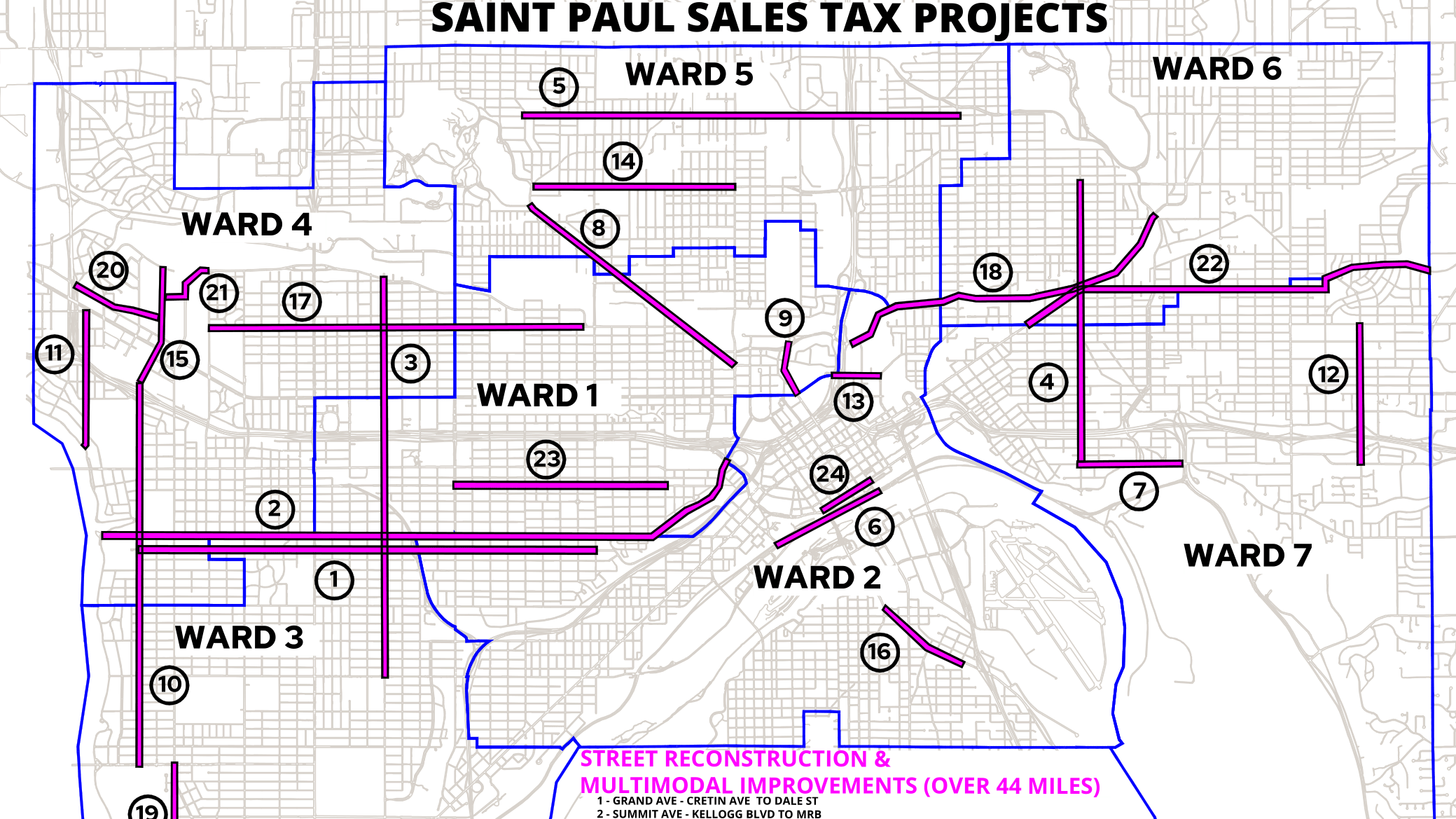

According to the Department of Public Works, most roads have a 60 year lifecycle and St. Paul’s streets are only planned to be replaced every 124 years. Public Works has already developed a 20 year plan for which streets they will be prioritizing, including portions of Shepherd Road and Cleveland Avenue in the West end and a portion Kellogg Boulevard in downtown.

The $738 million allocated through the tax increase for road improvement and reconstruction projects is planned to include a total of 24 arterial and collector roads, including some bridges, over 44 miles in each of the seven wards.

An additional $246 million is budgeted for Parks and Recreation improvements, with a focus on the city’s parks in the worst condition. Additionally, revenue from the increased sales tax would fund a new community center on the East Side of the city, a multi-purpose athletic complex, an environmental learning space at Crosby Farm Regional Park and investment in the River Balcony project along Kellogg Boulevard in downtown.

Read more: To find more details on the plans and the impacts of the 1% sales tax increase, visit stpaul.gov/salestax